Owning property in an investment portfolio provides a complementary source for potential return and income; however, most investors are not professionally trained with robust insights on real estate markets and sectors.

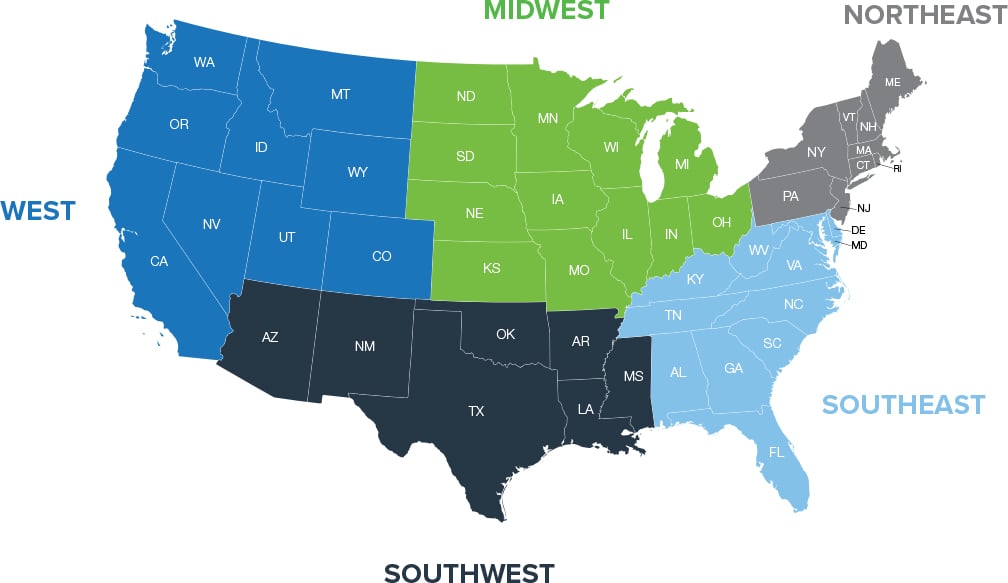

A Delaware statutory trust, or DST, is an investment structure in which multiple investors own fractional interests in a single property or portfolio of properties. Investors can gain access to institutional-quality property that may otherwise be out of reach. Using DSTs, investors can allocate assets to one or more DSTs, providing a more diversified real estate portfolio across geographic areas and property types.

DST offerings may be structured as a single property, a single geographic region or a combination of properties in a focused geography. For example, office properties in a major metropolitan city, self-storage properties in multiple locations, or a regional-based portfolio of properties.

Beneficial interests in DSTs are considered “like-kind” property for purposes of 1031 exchanges. In order to successfully execute a Section 1031 tax-deferred exchange, the replacement property must be like-kind to the relinquished property. Any real estate held for productive use in a trade or business or for investment purposes is considered like-kind. A primary residence would not fall into this category; however, vacation homes or rental properties may qualify.

DSTs Can Offer Real Estate Diversification Across Property Types and Geographic Location

Inland Private Capital Corporation is recognized as the industry leader in 1031 exchange transactions.*

*Source: Mountain Dell Consulting

.png?width=1129&name=image%20(1).png)

**Explanation of Terms & Calculations

Full-Cycle Programs are those programs that no longer own any assets. However, in certain limited situations in which the subject property(ies) were in foreclosure, IPC has negotiated with the lenders and advanced funds to the investors to allow the investors to exchange their beneficial interest in the original program for a proportionate beneficial interest in a new program, in order to continue their Section 1031 exchanges and avoid potential capital gains and/or forgiveness of debt tax liabilities. Because such exchanges result in an investment continuation, the original programs are not considered full-cycle programs for these purposes.

Weighted Average Annualized Rate of Return (ARR) For each full-cycle program, the ARR is calculated as the sum of total cash flows distributed during the term of the investment program, plus any profit or loss on the initial offering price, divided by the investment period for that program. To determine the weighted average for all programs, the ARR for each program is multiplied by the capital invested in that program, divided by the total capital invested in all full-cycle programs since inception (2001). To determine the weighted average in each asset class, the ARR for each program within that asset class is multiplied by the capital invested in that program, divided by the total capital invested in all full-cycle programs within that asset class since inception (2001). For a full list of program dispositions, see “Prior Performance of IPC Affiliates” set forth in the applicable Private Placement Memorandum.