Unprecedented is a word often used to describe events or conditions that suggest they have never occurred before. Indeed, the term has been applied to the social, economic, and market conditions we’ve witnessed since the onset of the pandemic. Business disruption, raging inflation, geopolitical unrest, and mounting recession concerns have painted a very uncertain outlook for commercial real estate.

Advisors assisting clients with their commercial real estate investments are rightly concerned that the current environment may present unique challenges we may not have encountered before. So, when evaluating private real estate offerings today, the sponsor’s experience in navigating challenging markets becomes paramount in determining which investments you’ll want to conduct due diligence on and introduce to your clients.

Lessons From History

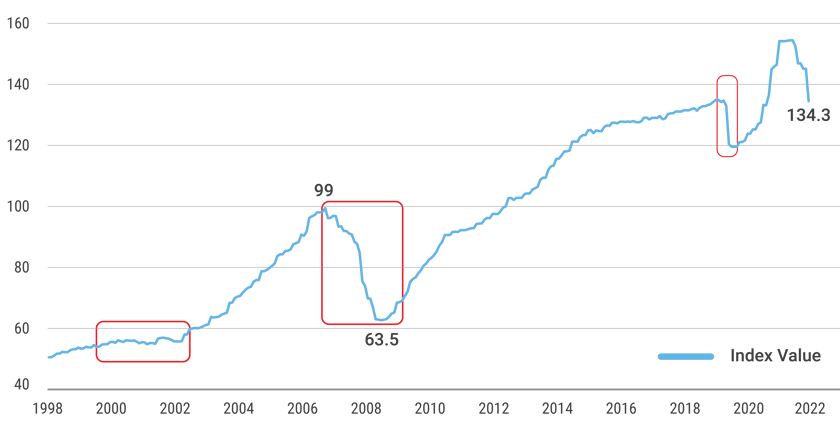

The Green Street Commercial Property Price Index illustrated below reflects the aggregate valuations of all commercial real estate property types from 1998 to December 2022. We’ve identified three distinct periods to highlight how stock market collapses impacted the industry.

Green Street Commercial Property Price Index®

Indexed to 100 in August 2007

Source: https://www.greenstreet.com/insights/CPPI

Source: https://www.greenstreet.com/insights/CPPI

Dot.com Market Collapse

When dozens of over-leveraged and hyper-inflated tech companies filed for bankruptcy as the tech sector collapsed in 2000, 6.2 trillion1 in wealth was wiped out, and commercial real estate valuations flatlined for the next two years. Developers and property owners who weathered this drought discovered how quickly investment capital could dry up during major market upheavals.

Global Financial Crisis

Similar to the dot.com debacle, the housing market collapse and ensuing global financial crisis of 2007-2008 saw another 6.0 trillion1 of wealth destroyed and sent the U.S. into an 18-month-long recession. Commercial real estate values tanked. As defaults mounted and employees lost their jobs, vacancies increased, and over-leveraged developers and owners sought protection in bankruptcy courts. Surviving firms of the global financial crisis and ensuing great recession learned that risk management must be prioritized and is essential to a firm’s business strategy.

COVID-19 Global Pandemic

With startling swiftness, commercial real estate was entirely upended by the COVID-19 pandemic. Business closures, work-from-home mandates, and newly empowered tenants left owners scrambling to sustain rental income. And supply-chain snarls derailed development projects. While commercial real estate valuations recovered quickly through November 2022, the industry was down year-to-date 2022. Foreclosures weren’t as high as many predicted, but sponsors were reminded of the defensive power of low leverage during the economic downturn.

Is commercial real estate heading into a cycle that could impact valuations and rents similarly to these previous episodes? No one can accurately predict. But aligning with a sponsor who has executed for investors in good times and bad is not only smart, it’s critical.

When evaluating investment offerings today, ask sponsors this simple question: Can you show me how your investments performed during the challenges of 2002, 2008, and 2020? You may find that many providers missed those events. Those that didn’t are likely the industry leaders now with conservative investment philosophies and strong balance sheets to help take on whatever market shifts may come.

For additional insight into Inland’s 50+ year history of executing for investors, visit us at https://inlandadvisorsolutions.com/.