Search Engine Marketing (SEM) strategy resulted in a significant increase in qualified prospects

Ask financial professionals today what their greatest challenge is in managing their practices and you will often hear a common theme about not having enough time to prospect for new clients. That was a primary reason why Inland created The Inland Academy. With this new platform, our goal is to help financial professionals grow their businesses by making the prospecting process easier and more effective.

Recently, The Inland Academy helped accomplish our objective for a registered investment advisor (RIA) with a specialty focus in 1031 exchanges and Delaware Statutory Trusts (DSTs). By working directly with the firm and utilizing a leading digital consulting agency that specializes in helping RIAs grow assets in a digital world, the group was able to significantly increase qualified leads as potential new clients.

Prior to engaging with The Inland Academy and the digital consulting agency, the RIA had struggled with marketing tactics in many of the same ways other financial professionals had, including:

- A rarely updated website that read like a brochure

- A minimal social media presence

- An ineffective paid search (digital advertising) strategy

The RIA had engaged several different marketing companies throughout the years, but none of those agencies was able to create a sustainable program that had measurable impact on the firm’s growth, which is a common situation and outcome many financial professionals find themselves struggling with.

The Inland Academy and the digital consulting agency helped develop a comprehensive strategy to amplify the strengths of the RIA’s practice. First, the website was redesigned to include content offers that would educate visitors and turn that web traffic into leads. Next, a robust content creation and publishing program was implemented, as were multiple lead-capture platforms. Lastly, one of the most important elements of the overall strategy, was the development and execution of a SEM plan.

Search Engine Marketing

Many may be familiar with inbound marketing (inbound), which is a roadmap for how to potentially grow businesses in a digital world where prospects and clients have information at their fingertips. SEM is a vital part of any successful inbound marketing program, but it is often misunderstood and misused. If not directed by the skilled hands of experts, this lead generation method can be expensive and entirely ineffective. But what is SEM? By definition . . .

Search engine marketing (SEM) is a digital marketing strategy used to increase the visibility of a website in search engine results pages (SERPs).

While the industry term once referred to both organic search activities such as search engine optimization (SEO) and paid, it now refers almost exclusively to paid search advertising.

Search engine marketing is also alternately referred to as paid search or pay per click (PPC).

A well-executed SEM program is one the most effective tools available to financial professionals in growing their businesses and standing out in a very competitive space. Prospective clients are searching online every day for answers to their financial questions and for experts who can help them plan effectively. According the SEMrush, a leading SEO research tool, there are 135,000 searches every month for the phrase, “financial advisors”. SEM enables financial professionals to have their ads show up prominently alongside the top search queries. This high degree of visibility is somewhat dependent on the amount of dollars a financial professional chooses to spend but relies heavily on the quality of the selected keywords.

Keywords are the cornerstone of SEM. As users search to find solutions and answers, search engines zero in on specific keywords and phrases to deliver results most likely to immediately satisfy the users’ queries. Keyword research, analysis and refinement is an art and a science, and as mentioned before, it requires a keen understanding of how search engine algorithms work for one’s SEM program to thrive.

From Zero to Significant in Six Months

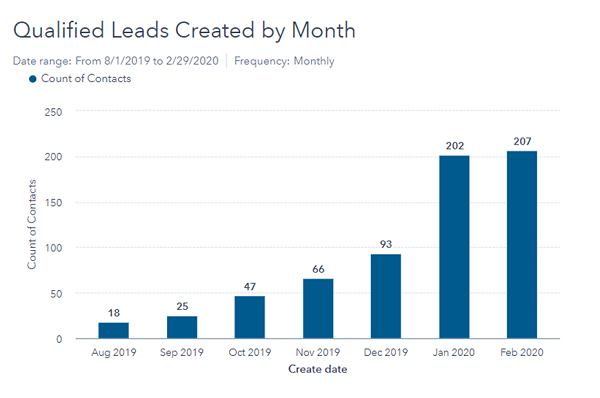

After executing the new marketing strategy for six months, this particular RIA’s program did, indeed, thrive and the results were eye-popping. The SEM program exponentially increased the advisor’s visibility in searches which resulted in increased web traffic, registrations, downloads, and scheduled calls.

- 247% increase in website visits (from 2,000 to over 7,000/month)

- 238% increase in offer downloads (from 13 to 44/month)

- 50% increase in registrations for property viewing (from 22 to 33/month)

- Over 1,000% increase in qualified leads from accredited investors (from 18 to over 200/month)

The success of this SEM program can be attributed to several tactical initiatives that included:

- Extensive preliminary keyword research

- Strategic and competitive bidding on the most desirable keywords

- Geotargeting ads to saturate the most important markets

- Implementing responsive search ads

- Ensuring that traffic was driving to website pages that were more likely to convert

- Constantly optimizing best performing content and creative in ads

Collectively, these efforts ensured the RIA was consistently earning more impressions and more qualified prospects with eyes on the content.

A well-designed digital marketing program is essential for financial professionals who are seeking to generate qualified leads and grow their practices. Executing on such a program may require the guidance of an experienced digital consulting agency to help navigate the today’s digital marketing world.