COVID-19 quickly grew into a global pandemic affecting the health of mankind, economies, capital markets and individual businesses.

Prior to the COVID-19 outbreak, the S&P 500 Index had produced an average annual return of 9.8 percent over the last five years ending January 31, 2020, and the Dow Jones Industrial Average (the DOW) set its highest closing record on February 12, 2020.[1] Commercial real estate had a very favorable outlook going into 2020, with CBRE projecting “slowing but sufficient growth that will generally support strong property market fundamentals”.[2] While the first cases of COVID-19 were reported in the U.S. in late January 2020, the number of confirmed cases significantly increased by mid-March. As the number of confirmed cases grew, U.S. capital markets experienced dramatic changes, including record-setting point drops and the start of the first bear market in nearly 11 years.

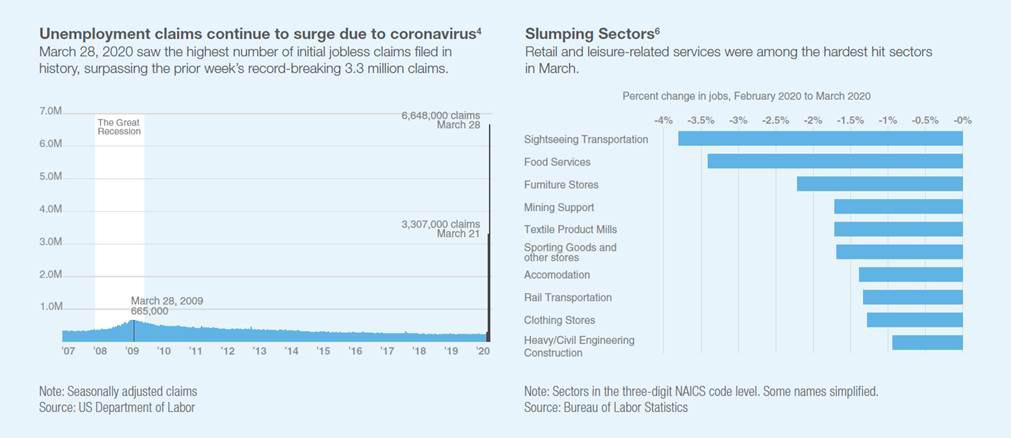

The commercial real estate (CRE) industry has been highly affected by COVID-19, primarily due to the unprecedented and necessary response including the temporary closure of non-essential businesses. As of April 7, 2020, forty-two states had ordered businesses to temporarily close and residents to stay home, resulting in more than 316 million people working and eating at home.[3] This has had a substantial impact on the American job market, with first-time claims for unemployment benefits surging more than 3,000 percent since March 21, 2020. The Department of Labor reported 10 million U.S. workers filed for unemployment benefits in the last two weeks of March.[4] The previous record high of unemployment filings in a week was 695,000 in 1982. The Congressional Budget Office expects an unemployment rate above 10 percent for the second quarter.[5]

This is neither an offer to sell nor a solicitation of an offer to buy any security, which can be made only by an offering memorandum or prospectus that has been filed or registered with appropriate state and federal regulatory agencies and sold only by broker dealers and registered investment advisors authorized to do so. An offering is made only by means of the offering memorandum or prospectus in order to understand fully all of the implications and risks of the offering of securities to which it relates. A copy of the applicable offering memorandum or prospectus must be made available to you in connection with any offering. Please see below for important disclosures.

On March 27, 2020, Congress passed a COVID-19 stimulus bill, known as the CARES Act. This stimulus was put in place to add $2.2 trillion directly into the U.S. economy, including providing aid to all CRE sectors, mostly in the form of liquidity support for tenants. While the stimulus package may provide relief to CRE tenants and owners, it does not extend, at this point, to CRE lenders, directly affecting CRE capital markets.

The effects of COVID-19 are being felt across the globe in one way or another. The fundaments of commercial real estate going into 2020 were strong and positioned well for the short- to mid-term disruption we are facing today. While temporary, the length and ultimate magnitude of COVID-19’s effects are unfortunately uncertain and multiple aspects of the economy, including commercial real estate, are expected to be negatively affected by the pandemic.

COVID-19 Pandemic’s Impact on Commercial Real Estate SectorsHospitality

Industrial

Multifamily

Retail

Office

CRE Capital Markets

|

Sources:

[1] Barrons. The Dow Just Hit a Record High. It’s About Time. February 12, 2020.

[2] CBRE Research Real Estate Market Outlook 2020 U.S.

[3] New York Times. See Which States and Cities Have Told Residents to Stay at Home. April 7, 2020.

[4] CNN Business. A 3000% jump in jobless claims has devastated the US job market. April 2, 2020.

[5] The New York Times. White House Debates How Far to Go on Face Mask Guidelines. April 7, 2020.

[6] The Wall Street Journal. The March Jobs Report in Charts. April 3, 2020.

[7] CBRE Flash Call: COVID-19 Impact on Commercial Real Estate. March 18, 2020.

[8] Wall Street Journal. Warehouse Hiring Surge Defies Crashing U.S. Jobs Market. April 3, 2020.

[9] Yardi National Multifamily Report. March 2020.

[10] March 17, 2020 Gartner Survey. Gartner HR Survey Reveals 88% of Organizations Have Encouraged or Required Employees to Work From Home Due to Coronavirus.

[11] March 30, 2020 Gartner Survey. Gartner CFO Survey Reveals 74% Intend to Shift Some Employees to Remote Work Permanently.

Disclosure

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forward-looking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Investments in real estate assets are subject to varying degrees of risk and are relatively illiquid. Several factors may adversely affect the financial condition, operating results and value of real estate assets. These factors include, but are not limited to:

- changes in national, regional and local economic conditions, such as inflation and interest rate fluctuations;

- local property supply and demand conditions;

- ability to collect rent from tenants;

- vacancies or ability to lease on favorable terms;

- increases in operating costs, including insurance premiums, utilities and real estate taxes;

- federal, state or local laws and regulations;

- changing market demographics;

- economic risks associated with a fluctuating U.S. and world economy;

- changes in availability and costs of financing; and

- acts of nature, such as hurricanes, earthquakes, tornadoes or floods