We have discussed the vital role you, as a fiduciary, can play in helping your clients who are considering a 1031 exchange evaluate Delaware statutory trust (DST) sponsors and select a Qualified Intermediary (QI) to execute the transaction.

You also can help clients assess the property or properties that may be accessed through a DST, and why some property types may be positioned to outperform.

Selecting a Commercial Property Type

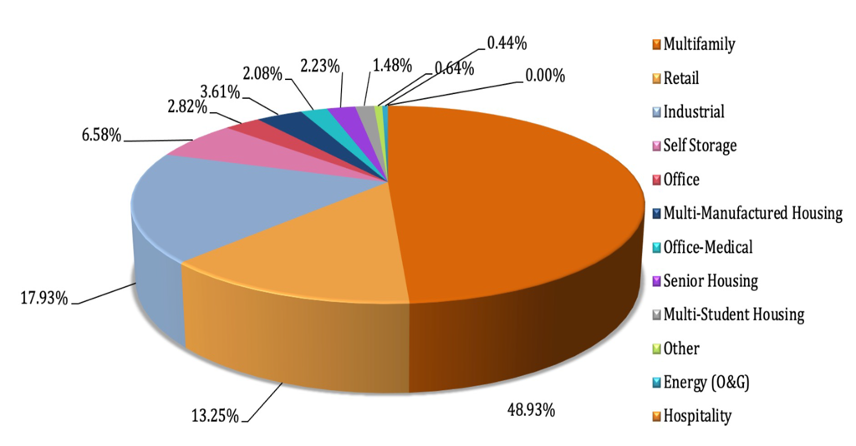

When most investors think of commercial real estate (CRE), the property types that typically come to mind are multifamily, industrial, office, and retail -- long considered the “big four” of the real estate industry or the core commercial property types. But the CRE landscape is much broader, and DST sponsors can select from a range of property types for their offerings.

According to Mountain Dell Consulting, a research firm that tracks the securitized real estate investment industry (of which DSTs are a significant part), there were more than a dozen different CRE asset classes represented in their 2021 year-end summary.

|

Sales by Asset Type |

|

| Source: Mountain Dell Consulting |

Look to Where Sponsors Invest

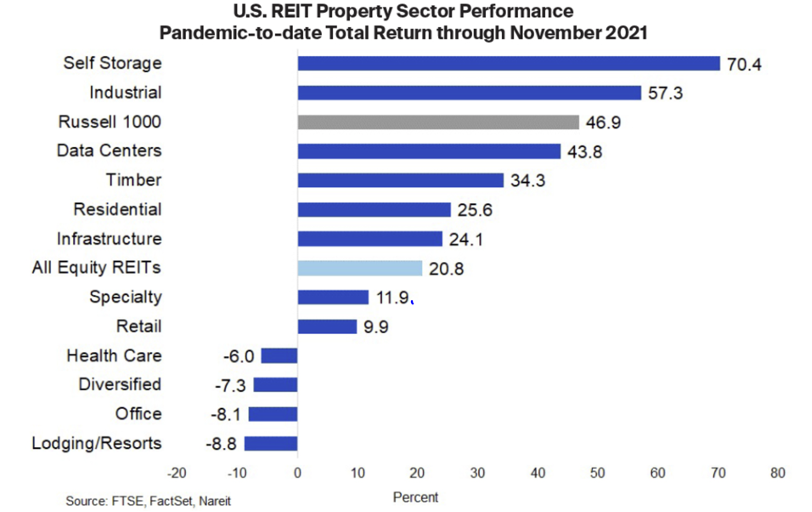

As you can see, multifamily dominated the securitized 1031 exchange space in 2021 with retail and industrial assets also receiving significant investor interest. Keep in mind, however, that bigger is not necessarily better when it comes to CRE strategies. Certain sub-sectors can outperform, as reflected by the performance of self-storage assets in the post-pandemic recovery (as held by public REITs).

|

| Source: reit.com |

As you evaluate DST offerings on behalf of your clients, it may be wise to work closely with a DST sponsor with extensive experience across different property types. Market and economic conditions can impact CRE asset classes in different ways. A sponsor expert in multiple property types may be able to provide access to real estate better positioned for the current and future environment.

According to a recent 2022 industry outlook from Real Assets Advisor, “Inland Private Capital Corporation is one sponsor that offers a broad menu of alternatives across property types such as multifamily, self-storage, student housing, retail, and net-lease assets.”

In his interview with the publication, Keith Lampi, President and COO of Inland Private Capital Corporation, affirmed the approach: “We never want to be beholden to one investment strategy because we know that as the market evolves, we want to put ourselves in a position to be nimble.” Lampi stated that Inland seeks to “evolve with a forward-looking mindset and interact with sectors that make good long-term sense at that point in time.”

Self-storage also remains a focus for Inland Private Capital Corporation, according to Real Assets Advisor. “Every time we bring a self-storage product to market, our investor base is incredibly active and interested in allocating a portion of their capital to that sector,” said Lampi. “That interest stems from many of the same factors driving interest in multifamily. Storage owners have the ability to evolve with the market and push rental rates on a regular basis and increase value by virtue of their property management expertise, which really resonates with the broader investment community given the current inflationary environment.”

Optimism Looking Ahead

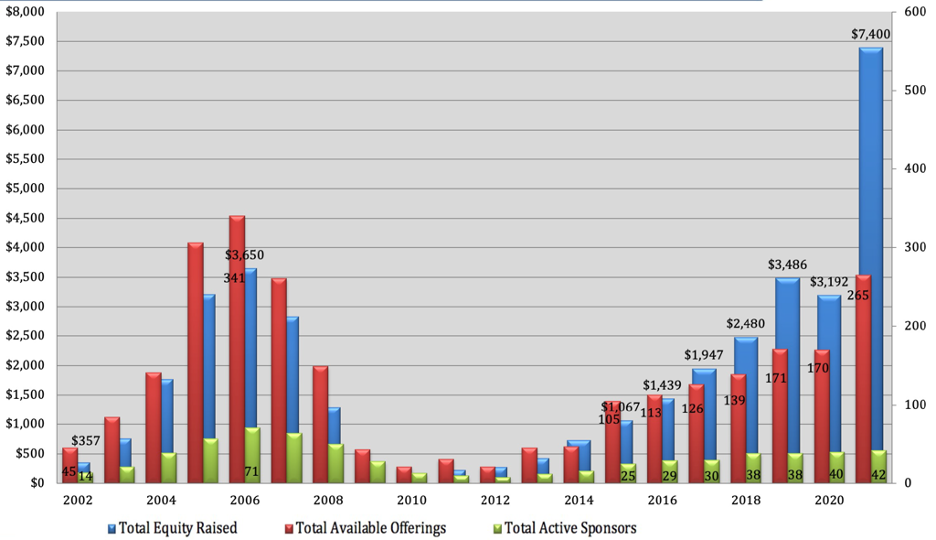

Will the securitized 1031 exchange industry witness the dynamic growth of 2021 in coming years?

|

| Source: Mountain Dell Consulting |

Perhaps industry growth will settle into a steadier pattern. Still, many of the same conditions which helped propel 2021’s industry growth remain in place: high occupancy rates, rising rents, limited supply, and potential legislative limits on tax benefits for future transactions. As a result, the DST will likely remain a compelling option in 2022 for your clients interested in owning commercial real estate.