Chances are, you have clients who hold investment property and may have heard them mention a 1031 exchange. That wouldn’t be surprising, considering this 100-year-old provision of the Internal Revenue Code remains one of the most popular tax deferral and wealth accumulation strategies available to business and investment property owners.

Increasingly, RIAs are familiarizing themselves with their clients’ real estate holdings. For many, investment real estate represents a significant portion of their net worth or income and should be included in their overall financial plan.

A Time-Tested Tax Deferral Strategy

Section 1031 of the Internal Revenue Code allows investors to defer the payment of capital gains taxes that may arise from the sale of business or investment property. As long as the property sale proceeds are used to purchase “like-kind” real estate and certain other conditions are met, investors may earn significant tax benefits.

Real estate held for productive use in a trade or business or for investment purposes is considered “like-kind.” In addition, vacation homes and rental properties may qualify, but not a property owner’s primary residence. Examples of like-kind property include:

-

multifamily apartments

-

self-storage facilities

-

retail centers

-

office buildings

- industrial warehouses

Start With the Tax Rules and Guidelines

Investors must follow several specific guidelines to successfully execute a 1031 exchange transaction and defer capital gains taxes.

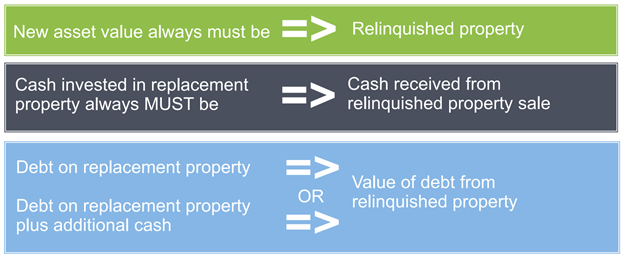

The graphic below summarizes the key rules you and your clients need to know in order to earn the tax benefits of a 1031 exchange transaction.

First, the value of the new, or “replacement” property must be greater than the value of the sold, or “relinquished” property.

Second, your client must invest at least all of the equity proceeds from the sale of the relinquished property into the replacement property.

Third, after reinvesting the equity, your client must meet the debt replacement requirements. This means that the debt on the replacement property, or the debt on the replacement property plus additional cash, must be greater than or equal to the debt on the relinquished property. This requirement is essential to a 1031 tax-deferred exchange transaction and is not always straightforward.

Meet the Deadline

Investors utilizing a 1031 exchange must also follow a strict timeline. From the day the exchanger closes on the relinquished property, they have 45 days to identify, in writing, the replacement property they plan to purchase. The timeline then allows for a full 180 days to close on the replacement property.

It’s essential to know these periods run concurrently and are based on calendar days.

Qualified Intermediary Required

Every exchange requires a facilitator, a Qualified Intermediary, or QI, to complete the transaction. The QI holds the proceeds from the sale of the relinquished property in a trust or escrow account to ensure the investor never has actual or constructive receipt of the sale proceeds, which would trigger capital gain consequences.

You will need to become familiar with these and other requirements if you are interested in helping advise your clients on 1031 exchanges. Look to future posts for additional 1031 exchange requirements discussions.

Expand Your Fiduciary Role

As mentioned, increasingly RIAs are including real estate-focused investment strategies in client financial plans and tracking the performance of those investments. Historically, real estate property owners would have received advice from an accountant or realtor during the transaction process, of which you likely had little involvement. However, as a fiduciary, it is important you understand the details of your client’s estate plan and how a 1031 exchange transaction may significantly impact their financial future. With knowledge of the sophisticated 1031 exchange process, you now have an extensive view of your client’s investment and real estate holdings, allowing you to provide more comprehensive advice and potential solutions to help them reach their investment goals.

Expand Your Services and Revenues with DSTs

You can potentially grow your business by expanding your knowledge of 1031 exchanges, via a Delaware statutory trust, or DST, which permits fractional ownership of institutional-quality real estate assets. Multiple investors can share ownership in a single property or a portfolio of properties, which qualifies as like-kind replacement property as part of an investor’s 1031 exchange transaction.

A DST investment takes all decision-making out of the hands of investors and places it into the hands of an experienced sponsor-affiliated trustee.

As you become familiar with DST sponsors and their offerings, you can offer your clients the opportunity to defer taxes with a passive investment that consists of professionally managed income-producing properties.

Learn More

If you would like to learn more about how fiduciaries can provide added value to clients by advising them on a 1031 exchange transaction, check out The Inland Academy for access to all our insights.