When the Opportunity Zone (OZ) investment program was launched as part of the 2017 Tax Cuts and Jobs Act, many had high hopes this tax-advantaged piece of legislation would draw widespread investor interest.

Despite a rocky start due to some ambiguities in the law’s original language, the program intended to drive development in economically distressed areas throughout the U.S., sponsors, and investors did embrace the concept. It was estimated by the White House Council of Economic Advisors at the end of 2019 that over 1000 OZ funds had been introduced.1

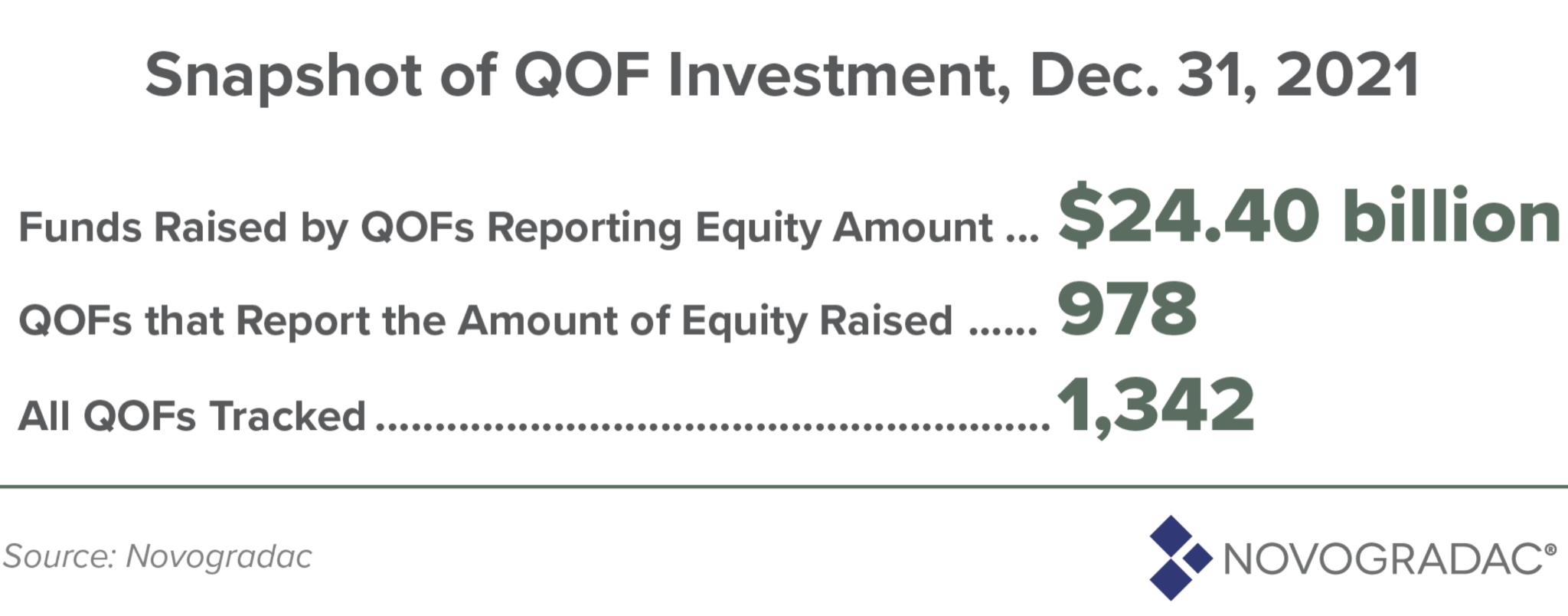

And if investment activity in 2021 is any indication, investor interest in opportunity zones is as robust as ever. According to research from Novogradac, a professional services firm that tracks the size and growth of Qualified Opportunity Funds (QOFs; the required investment vehicle for inventors to participate in OZs), investments were up sharply in the second half of 2021.

“As of the end of 2021, the 1,342 QOFs tracked by Novogradac (978 of which report a specific amount of equity raised) had raised $24.40 billion in equity. The jump of nearly $7 billion in reported equity since June 30, 2021, is the largest increase in any reporting period since Novogradac began tracking QOF investment in May 2019.” - novoco.com

This industry size reflected here may be understated, as Novogradac only reports on data collected from QOFs that voluntarily provide information on a rolling basis.

Novogradad also reports that cities supporting the OZ program and economic development and job growth in underserved communities are seeing significant investments at work.

“While the volume of investment from QOFs tracked by Novogradac is impressive, more significant may be where the investment is being made: 20 cities each have at least $200 million in planned QOF investment.”- novoco.com

Momentum Drivers

We believe a few factors are driving continued investor interest in Opportunity Zones. And while the “tax reduction” benefit of the OZ program expired on December 31, 2021, two compelling features remain.

Tax-Deferral on Any Asset

As you may be aware, a unique aspect of the OZ program is the ability for investors to defer capital gains tax on the sale of ANY property type. Unlike the 1031 exchange, which only allows investment property owners to defer taxes when exchanging real estate property, the OZ program enables investors to defer gains on stocks, bonds, mutual funds, art, jewelry, cryptocurrency, and even businesses.

For investors who may have experienced significant market gains in 2021 or cryptocurrency traders who hold outsized short and long-term gains, OZ’s create a unique opportunity to defer capital gains taxes which otherwise would erode very substantial capital appreciation.

Desire to Eliminate Capital Gains

The OZ program provides a rare opportunity to potentially eliminate tax on gains earned from the OZ investment for those with long-term investment horizons. Investors who remain invested in the QOF for at least ten years won’t be required to pay federal capital gains taxes on any gains realized from the QOF investment.

Amidst heightened market volatility and recent market corrections, liquidity may be less of a concern for many investors seeking long-term capital appreciation, making this “tax elimination” benefit attractive.

Choices Abound

Properties that qualify for opportunity zone development include any tangible property used in trade or business. This means investors have a range of property types to choose from when evaluating the investment strategies of different QOFs.

Today, for example, many investors are attracted to the multi-family real estate sector, which has performed well throughout the pandemic recovery. It also appears to be well-positioned to continue that trend amidst a shortage of housing supply in the U.S. Several other real estate sectors may also be of interest.

And because there are so many QOFs currently raising capital, you can evaluate investments in different geographies and other markets for your clients.

If you are interested in learning more about opportunity zones or other private real estate investments for your clients, visit the Inland RIA Experience here.

1State Of The Opportunity Zone Marketplace In 2021 (forbes.com)

2 Novogradac Report: Tracked QOFs Raised Nearly $7 Billion in Equity in Second Half of 2021

3 Novogradac Report: QOF Investment Up Sharply in Final Six Months of 2021

This communication is not intended as tax advice.

This website is neither an offer to sell nor a solicitation of an offer to buy any security which can be made only by a prospectus, or offering memorandum, which has been filed or registered with appropriate state and federal regulatory agencies, and sold only by broker dealers and registered investment advisors authorized to do so.

The Inland name and logo are registered trademarks being used under license. "Inland" refers to some or all of the entities that are part of The Inland Real Estate Group of Companies, Inc. which is comprised of a group of independent legal entities some of which may be affiliates, share some common ownership or have been sponsored and managed by such entities or subsidiaries thereof including the Inland Real Estate Investment Corporation (Inland Investments) and Inland Securities Corporation. Inland Securities Corporation, member FINRA/SIPC, is dealer manager and placement agent for programs sponsored by Inland Investments and Inland Private Capital, respectively. For more information on Inland Securities Corporation, visit FINRA BrokerCheck.