As financial professionals and investors reassess commercial real estate strategies amidst a challenging environment that includes persistent inflation, high interest rates, tightening Fed policy, and the potential for a recession, self-storage is an asset class that is gaining increasing attention.

Long viewed as a diversification strategy with a low correlation to stocks and bonds, real estate historically has been an effective inflation hedge, with certain sectors holding up well during periods of market turbulence. One of those sectors is self-storage.

Self-Storage: A Large, Dynamic, Growing Sector

The self-storage sector has grown to more than 1.7 billion square feet of space in 2023, more than the size of 26,800 football stadiums.1 In 2022 alone, nearly 39.9 million rentable square feet was delivered, yet this new supply represented only 2.3 percent of existing inventory, suggesting room for additional growth. 1

Types of self-storage facilities range from inside and outside to drive-up, open for business hours only or open 24 hours every day. Specialized properties may be climate-controlled or dedicated to business, military, or student clientele. With a range of options, we believe that self-storage is well-equipped to adapt to economically challenging markets. Self-storage has seen significant growth over the last decade, even amid a global pandemic, economic turbulence, and market uncertainty, and it is positioned to continue.2

Lifecycle Orientation

Since our nation’s founding, Americans have been on the move and have been looking for more space. These enduring cultural characteristics help drive the demand for self-storage. Renter appetite is largely derived from life events often referred to as the four Ds, all of which occur irrespective of the economic environment:

- Death

- Divorce

- Dislocation

- Downsizing

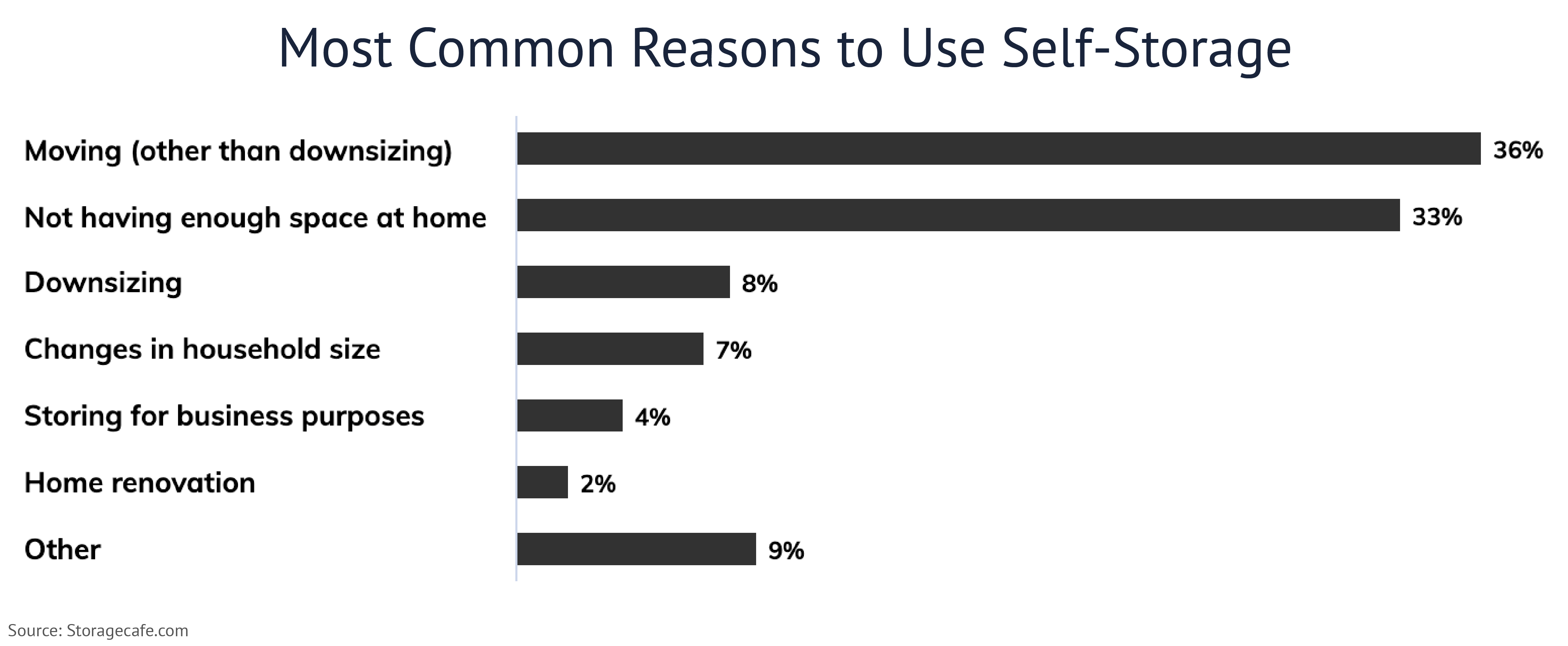

The need for self-storage arises from life changes and events. Whether moving, downsizing, or needing extra space for home or business, Americans increasingly use self-storage. In fact, about 1 in 5 Americans now uses self-storage.1

|

| Source: Storagecafe.com |

Demographic Demand Drivers1

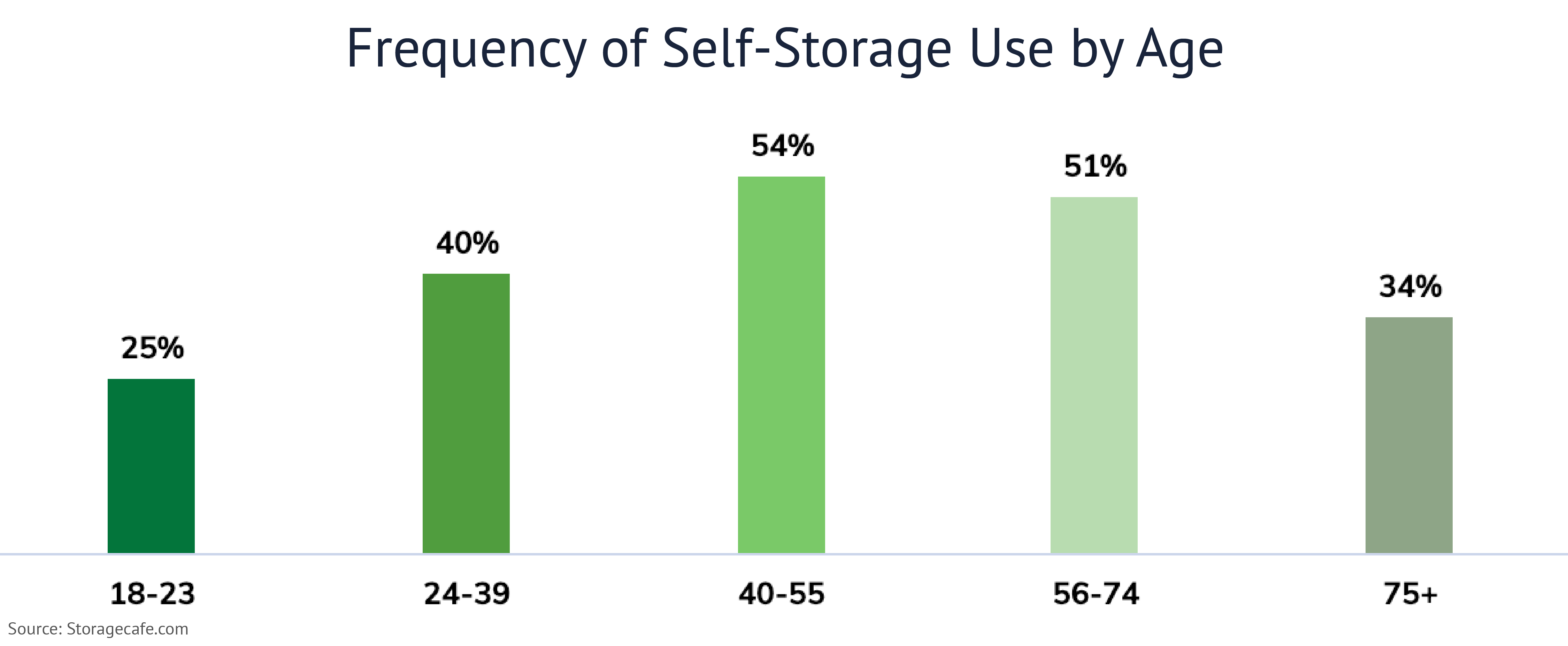

Which generations use self-storage? The reality is that all ages over 18 do, however, Gen-Xers and Baby Boomers are most likely to store belongings in a storage unit. Over half of Gen-Xers and Baby Boomers are using self-storage. 40 percent of Millennials, 34 percent of seniors over 75, and 25 percent of Gen-Zers also use self-storage. The youngest and oldest may still be acquiring or shedding belongings but are still significant customers for self-storage facilities.

|

| Source: Storagecafe.com |

The popularity of self-storage across age groups is another contributor to the demand for the sector spanning economic cycles.

Market-Cycle Resilience

The self-storage sector recovered quickly following the Great Financial Crisis of 2007-2009. Though some tenants walked away from storage units at the time due to job loss, the sector bounced back in 2009 with notable performance.

Should another economic downturn be on the horizon, the strong fundamentals supporting self-storage would suggest that the sector is positioned to hold up well in future recessionary periods.

Self-storage continued to prove resilient throughout the pandemic, with many companies shifting to a hybrid workplace culture. Employees required additional space to create home offices and workout rooms, leaving household furniture displaced.

Businesses and restaurants looked to self-storage as an inexpensive option to store company equipment, extra tables, and chairs, displays, and inventory as unprecedented pandemic-related restrictions shuttered thousands of businesses and restaurants throughout the U.S.

While self-storage facilities are not immune from a severe economic downturn, recessions can support the demand for storage units. Changes in living and work situations caused by employment dislocations can increase the need for storage.

Management Flexibility

For added protection against rising vacancies, self-storage has a low break-even occupancy rate compared to other real estate sectors, as low as 60 percent.3 Self-storage also provides management with the flexibility to navigate downturns with a comparatively rapid eviction process for non-paying tenants. Managers then have the right to auction the contents of a delinquent unit to cover unpaid rent.

Inflation Hedge

The self-storage sector entered 2023 in a strong position. With social behaviors normalizing post-pandemic, the sector is continuing to outperform previous market cycles. Moreover, rising rents reflect how the sector can serve as an inflation hedge.

According to the Marcus & Millichap September 2022 Self-Storage National Report, the average asking rent for a standard 10-foot by 10-foot unit was up 15 percent between the end of 2019 and mid-2022. Self-storage rental rates had slid modestly between 2016 and 2019 but have responded positively in the current period of rising inflation.4

Solid property fundamentals amid the pandemic sustained the self-storage sector in recent years. With units rented on a month-to-month basis, owners and operators can be nimble and flexible during challenging economic market conditions, making it an inflation hedge strategy for commercial real estate.

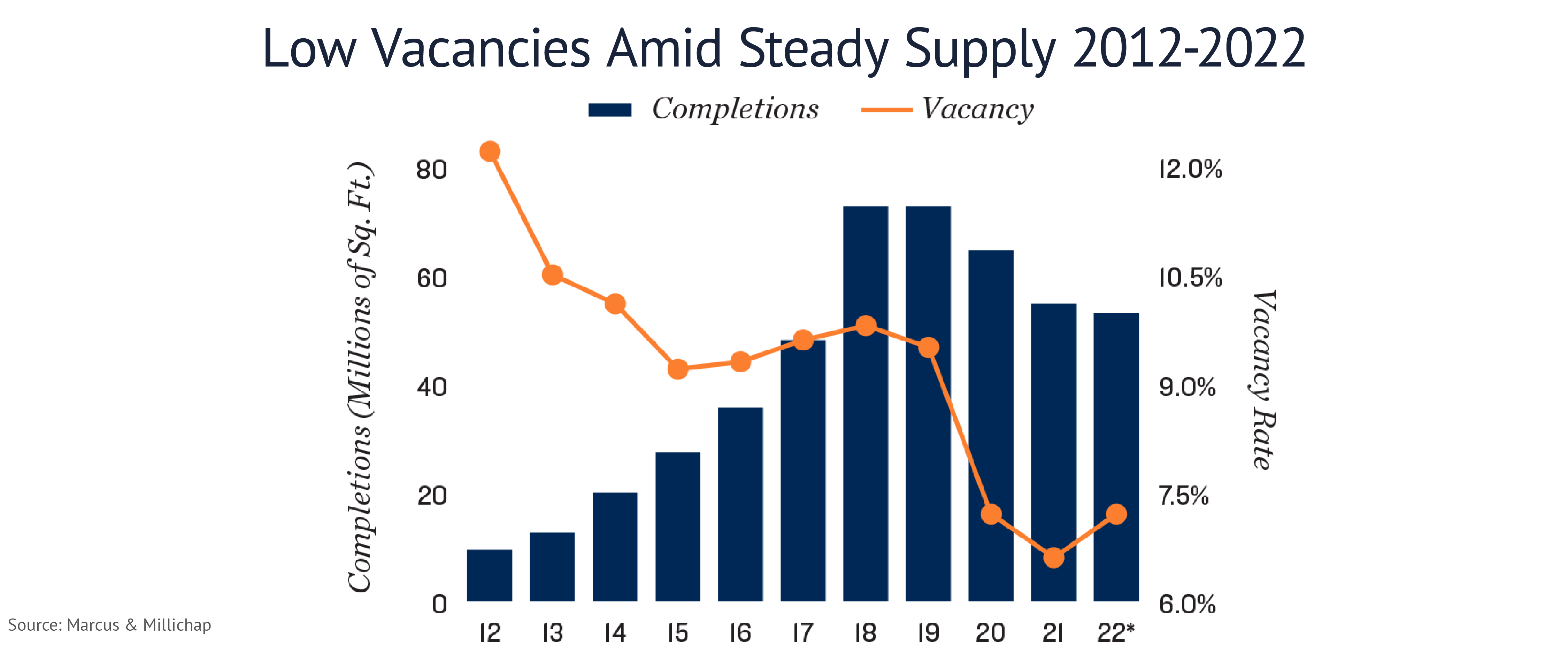

|

| Source: Marcus & Millichap |

Industry-wide vacancy rates dropped significantly between 2012 and 2021, representing an influx of demand for storage units. 2022 saw a mid-year vacancy rate of approximately 7.5 percent, despite significant new completions, reflecting significant underlying demand.4

|

|

Source: Marcus & Millichap |

Self-Storage: Key Risks

While self-storage has demonstrated resilience across economic environments, risks must always be considered, including but not limited to:

- Oversupply and Competition. Self-storage is a local, neighborhood-oriented business. Developers may build too many units for a locale, increasing competition as well as driving rents down and vacancies up.

- Reduced Demand. Adverse changes in the local or national economy can reduce demand for self-storage units.

- Changes in Law or Regulation. Adverse changes in zoning or the laws and regulations applicable to real estate operators can impede operations.

- Demographic Changes. Changes to neighborhood or regional populations can negatively impact self-storage demand and economics.

- Tenant Risk. Real estate revenues depend upon the financial condition of tenants, who may suffer from declining income or even bankruptcy or insolvency.

Within commercial real estate, self-storage is a sector that has historically performed well during periods of economic and market upheaval. And the strength of the sector throughout the pandemic reaffirms how the asset class can perform even during the most challenging periods.

For more insights into how allocating to commercial real estate may help you build more durable portfolios, download our newest guide: The Search for Resilient Real Estate

1 Self Storage Industry Trends. Storagecafe.com. June 2023

2 Self-Storage Successfully Navigates Market Cycles. Inland Insights. March 27, 2023

3 Tips on How to Invest During a Recession. InvestNext

4 Self-Storage National Report. Marcus & Millichap. Q3, 2022