2020 presented a range of challenges for commercial real estate due to the global pandemic that launched the United States economy into a recession. Multifamily housing experienced healthy demand over the last decade, positioning the sector to potentially absorb the impacts of the recession.

| Prior to the pandemic, single-family housing was under-supplied, leading to increased demand and adding additional pressure on the low single family housing supply. The gap between home prices and rent growth suggests renting may be a better option in many areas. With some 26.6 million 18- to 29-year-olds living with their parents, pent-up demand can be expected once this cohort enters the job market and attains financial stability.1 Current macroeconomics are projected to result in a decline in U.S. homeownership to 62.1 percent, the lowest rate in more than 20 years. Depending on the effects of the pandemic and current recession, the demand for rental housing could increase somewhere between 33 and 49 percent through 2025.2 | Apartment Rent Tracker 93.5% of apartment households made full or partial rent payments in February 2021. Multifamily rental payments did not dip below 93 percent in 2020 or through February 2021. Source: NMHC.org |

With many employees still working from home, the impact on urban rental submarkets is significant. Urban residents sought out suburban living due to their newfound flexibility and ability to live farther from the office. As a result, the suburbs are projected to lead the multifamily sector’s recovery in 2021.3 According to RealPage, asking rents for U.S. apartments climbed 0.6 percent in February 2021, rising at the fastest single-month pace since the middle of 2019. The good news is that this growth spread further than just suburban areas, with 140 of the 150 metros tracked by RealPage also reporting a slight increase in rental growth.4

Multifamily Markets – Challenges And Considerations For Recovery5

|

Factor |

Challenges |

Recovery Path & Considerations in 2021 |

| Work-From-Home | With work-from-home/work-from-any-where practices common for office workers, living near the workplace is far less relevant. | Most office workers were back by Q1, but with the ‘new norm’ it’s more likely that only 30-60% will go into an office, translating to less emphasis on living close to work. |

| Living Space | More living space desired as renters spend more time at home. | This should diminish as people go back to school and work; however, the hybrid nature of both will likely be a feature of the “new norm.” |

| Urban Amenities | Limited availability of entertainment, restaurants/bars, cultural amenities, sports, etc. | Urban amenities continue to return through 2021 (pace partly dependent on vaccine availability); 80-90% expected to be back by end of 2021. |

| Outdoor Space | Many renters desire greater access to outdoor options as an outlet for long hours in apartments. | Continued opening up of public outdoor amenities is expected to mitigate this factor; still, some renters will continue to move to less dense areas. |

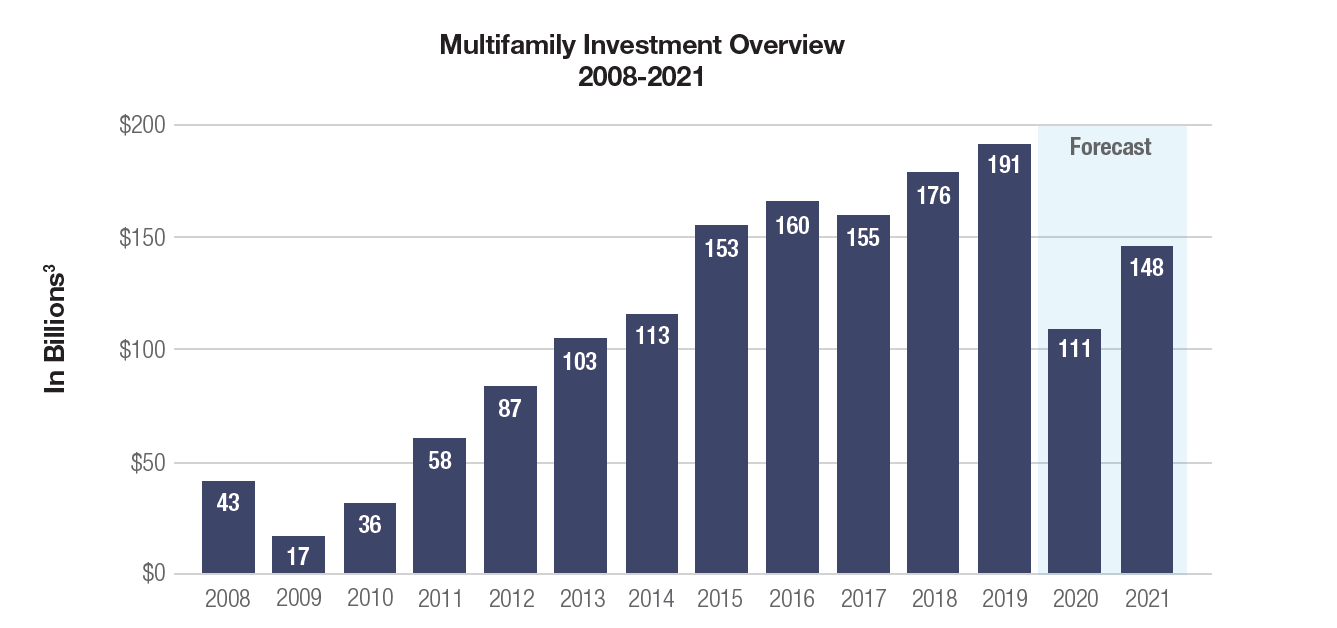

Multifamily Investment Volume Forecasted to Reach 33 Percent Increase over 20206

CBRE forecasts multifamily investments to reach $148 billion in 2021, a 33 percent increase over the 2020 estimate of $111 billion.3 At the onset of the pandemic, multifamily transactions virtually came to a halt, as sellers were not selling, and buyers were not buying. In addition, major lenders including Fannie Mae and Freddie Mac made drastic adjustments to their lending criteria and guidelines. These changes resulted in a very slow transaction period for the multifamily market, primarily between March and June 2020. As the months progressed, lenders began to change their guidelines, allowing sellers and buyers to become much more active. The increase in activity in 2020 may be partially due to the CARES Act introduced by Congress in late March, which provided Americans financial relief. Because income remained relatively healthy across most multifamily investments, the industry did not see much downward pressure on the pricing of these assets through the summer and fall.

In 2021, experts project that the multifamily sector may see some price adjustments, providing potential opportunity to acquire high-quality apartment deals at discounted rates. It is too soon to tell, as these adjustments have not yet happened as of March 2021, however the effects of the pandemic may catch up to the multifamily sector as financial relief may come to an end in the foreseeable future.

Sources:

1National Apartment Association. 2021 Apartment Housing Outlook.

2Middleburg Communities. Decline in Homeownership Rate will Boost Rental Demand. June 11, 2020.

3CBRE. 2021 US Real Estate Market Outlook – Multifamily

4https://www.globest.com/2021/03/05/apartment-rents-rise-at-fastest-pace-since-mid-2019/

5https://www.cbre.us/research-and-reports/2021-US-Real-Estate-Market-Outlook-Multifamily

6https://www.forbes.com/sites/forbesrealestatecouncil/2021/01/07/investing-in-multifamily-in-the-new-year

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forward-looking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Investments in real estate assets are subject to varying degrees of risk and are relatively illiquid. Several factors may adversely affect the financial condition, operating results and value of real estate assets. These factors include, but are not limited to:

- changes in national, regional and local economic conditions, such as inflation and interest rate fluctuations;

- local property supply and demand conditions;

- ability to collect rent from tenants;

- vacancies or ability to lease on favorable terms;

- increases in operating costs, including insurance premiums, utilities and real estate taxes;

- federal, state or local laws and regulations;

- changing market demographics;

- changes in availability and costs of financing;

- acts of nature, such as hurricanes, earthquakes, tornadoes or floods

- economic risks associated with a fluctuating U.S. and world economy, including those resulting from the novel coronavirus and resulting pandemic.