Manufactured Housing Communities (MHCs) are drawing increasing interest among institutional investors, shining a spotlight on this little-known sector of the commercial real estate industry. As noted in a recent article in GlobeSt.com, institutional capital now accounts for nearly a quarter of the market, which historically has been the domain of private investors.

“Institutional investors are flocking to manufactured housing assets as deal activity in the niche sector picks up speed. While private buyers have historically dominated the sector, institutional players are picking up steam, accounting for 23% of volume in the past two years, according to new data from Real Capital Analytics. That’s a sizeable increase from the 13% average posted from 2017 to 2019.” – globest.com September 2021

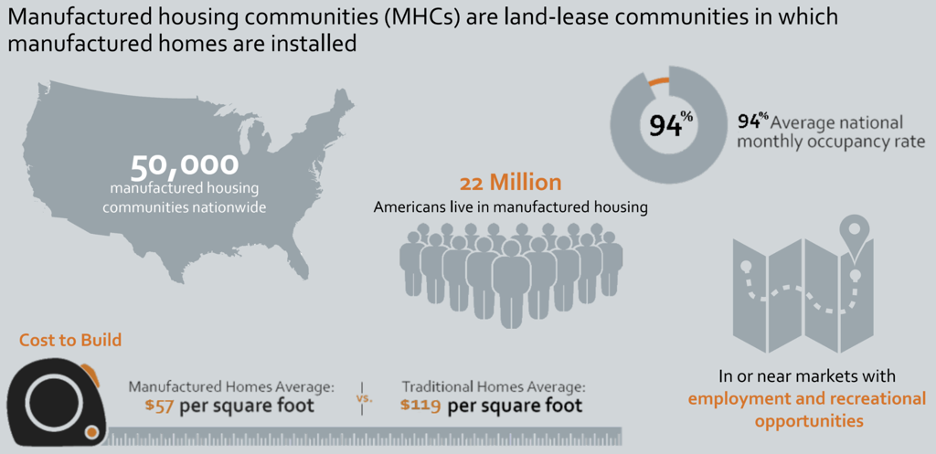

It is important to dispel a misconception about MHCs. Over the past few decades, MHCs have evolved from what many once viewed as trailer parks for low-income residents to what are now seen as beautiful, safe, affordable, and active communities meeting the needs of 22 million people. 1

By the Numbers

Source: MHInsider. Data Infographic on Manufactured Housing Industry Statistics and Trends. June 2021

MHCs are a vital source of affordable housing for homeowners seeking to live with other like-minded families in comfortable, secure, well-maintained communities that offer activities and amenities they might not otherwise have access to.

An Exceptional Real Estate Investment Sector

MHCs may not be a well-known sector of the private real estate market, but they are attractive investments for several reasons. MHCs have been a top performer across economic cycles and have historically delivered strong performance during recessions and economic upswings. Potential investor advantages of the asset class include:

- Limited Supply with Growing Demand

- Fragmented Niche Sector

- Inflation Hedge

- Cost-Effective Home Ownership Solution

- Strong Resident Loyalty

- Low Operating Costs

And with a cost-to-build ratio of roughly half the expense of a site-built home, MHCs are well-positioned to meet the needs of a growing population of retirees, many of whom are living on fixed incomes and will be looking for affordable housing.

Looking Ahead

MHCs will continue to fill a vital need for affordable housing across the U.S. As homebuyers continue to grapple with record-high home prices, limited supply, and rising mortgage rates, demand for MHCs is likely to remain high. Those factors should sustain interest among individual and institutional investors in this highly-desirable asset class.