Going to the supermarket has been a familiar and comforting ritual for many American consumers for decades. Although 2020 presented many changes and challenges, shoppers continued to make regular trips to the grocery store for fresh food or stockpiling of certain items.1

As a matter of fact, grocery stores were at the top of the essential category as they sell a wide variety of basic necessities that consumers purchased over the past year.2 Today’s grocery experience offers a range of brick-and-mortar and online shopping options, including home delivery apps that bring groceries right to the doorsteps of consumers at their preferred day and time. Grocery store sales have grown exponentially over the last five years due

| Grocery stores are deemed as essential retailers and therefore the effects of the pandemic have had minimal impact on this asset type. |

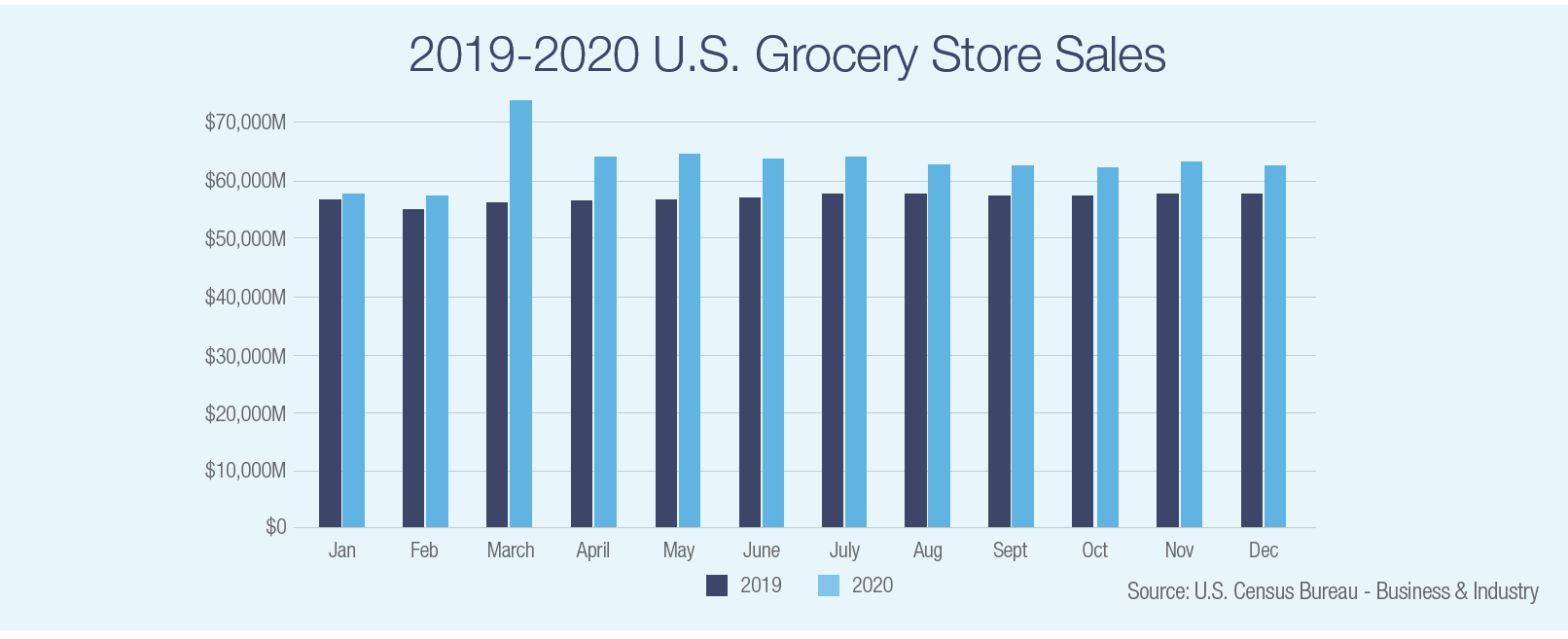

to a strong U.S. economy, and these necessity-based retailers are expected to perform even during difficult economic times.3 Prior to 2020, Americans found themselves with extra disposable income and many consumers shifted spending habits to purchase premium, organic and all-natural branded foods, helping the industry grow. The grocery industry experienced an exponential increase in grocery sales in 2019, topping the year off at $695 billion4, including online and in-store sales. Even during a challenging 2020, grocery sales reported $759 billion5 at year-end and experts project grocery store sales will continue to grow through 2025.3

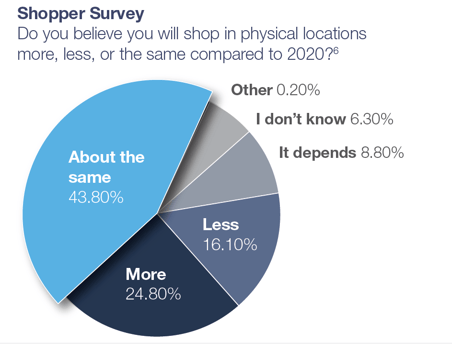

While 2020 may have changed some consumer shopping habits – and the year accelerated the evolution to online shopping, even for groceries – there is a large segment of the population that continues to want to venture out and have in-store experiences. According to a consumer behavior report by research firm, Raydiant, 46 percent of its respondents prefer in-store shopping over online.6 Retailers may use the in-store experience as a competitive advantage, by providing good customer service and connecting emotionally with shoppers, while significant product research and price comparison may happen online. Consumers are likely to return to a store if they had a positive experience.6

Another study conducted by Mercatus and Incisiv, grocery market analytical change firm, found that 78 percent of consumers prefer the brick-and-mortar grocery versus online shopping experience.7 The preference to either shop inside the grocery store or pick up curbside indicates that shoppers remain loyal to retailers with a physical store presence.8 As consumers continue to spend more time at home, many are focused on eating at home, thus supporting grocery sale revenue.

The opportunity to go to a physical store is still attractive to many and this may be an opportunity for brick-and-mortar grocers to focus on core experience factors that consumers value including quality and freshness of food, friendliness of staff and cleanliness of the store.9 Brick-and-mortar loyalty, focusing on vast food selections and store cleanliness is expected to help support increased sales revenue across grocery brands.10 Online grocery shopping is anticipated to also continue to expand, as this new ritual seems appealing to the consumer that enjoys the time savings with buying online, no lines inside stores and not having to deal with parking challenges. However, retailers are expected to use a combination of both, online and in-store shopping, to ensure success of its stores in the years to come.

Sources:

1https://www2.deloitte.com/us/en/insights/industry/retail-distribution/future-of-fresh-food-sales/pandemic-consumer-behavior-grocery-shopping.html

2https://www.globest.com/2021/02/18/the-pandemic-underscored-the-importance-of-essential-retail/

3IBIS World. Supermarkets & Grocery Stores in the US industry outlook (2020-2025)

4US Census Bureau Retail Sales Data 2019

5US Census Bureau Retail Sales Data 2020

6https://retailleader.com/consumers-still-prefer-store-shopping

7https://www.supermarketnews.com/online-retail/online-grocery-more-double-market-share-2025

8https://www.supermarketnews.com/retail-financial/food-home-will-continue-drive-grocery-sales-2021

9https://www.supermarketnews.com/consumer-trends/supermarket-customer-satisfaction-rebounds-amid-pandemic

10https://www.bloomberg.com/press-releases/2020-09-17/online-grocery-sales-projected-to-reach-250b-by-2025-according-to-new-research-from-mercatus-and-incisiv

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forward-looking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Investments in real estate assets are subject to varying degrees of risk and are relatively illiquid. Several factors may adversely affect the financial condition, operating results and value of real estate assets. These factors include, but are not limited to:

- changes in national, regional and local economic conditions, such as inflation and interest rate fluctuations;

- local property supply and demand conditions;

- ability to collect rent from tenants;

- vacancies or ability to lease on favorable terms;

- increases in operating costs, including insurance premiums, utilities and real estate taxes;

- federal, state or local laws and regulations;

- changing market demographics;

- changes in availability and costs of financing;

- acts of nature, such as hurricanes, earthquakes, tornadoes or floods

- economic risks associated with a fluctuating U.S. and world economy, including those resulting from the novel coronavirus and resulting pandemic.