As economic uncertainty swirls, some commercial properties show resilience

As investors remain focused on protecting and growing their wealth, many see 2024 as another year of continued market uncertainty. Conflicts in Ukraine, Gaza, and potentially Taiwan cast an ominous cloud over the global economy that could disrupt domestic and international markets.

The direction of future Fed action to reduce rates remains unknown and can often change course based on a few simple words uttered at a Federal Open Markets Committee meeting. And while consumer confidence appears to have rebounded early this year, a looming $5 trillion credit card debt is hardly a reassuring measure that we are out of the woods from a potential recession. Even if a recession is avoided, a best-case scenario might point to a lower Gross Domestic Product (GDP) growth environment.

Rethinking Portfolio Allocation

Amidst these current uncertainties, you may need to boost your allocations to life-event-driven asset classes if the stock or bond markets turn sideways. 2022 – when many saw their 60/40 stock and bond portfolios drop double digits – is not too far removed from investors’ minds.

In the alternative investment space, commercial real estate is often viewed as a preferred asset class due to its low correlation to publicly traded securities. However, commercial real estate is a broad asset class composed of many sectors that often perform quite differently. So, the type of real estate strategy used is more important than ever.

Commercial Real Estate Challenges?

You may be aware that high interest rates and stubborn inflation have taken a toll on many commercial real estate properties as the valuation gap between buyers and sellers widens and owners grapple with refinancing expiring loans at today’s much higher rates that can quickly make a property uneconomical.

These challenges are real and, we believe, not likely to go away any time soon, but it’s important to know that, much like the broader economy, commercial real estate experiences its own market cycle, and a repricing phase of assets is simply one stage of the cycle that not all sectors will experience at the same time.

The Commercial Real Estate Cycle

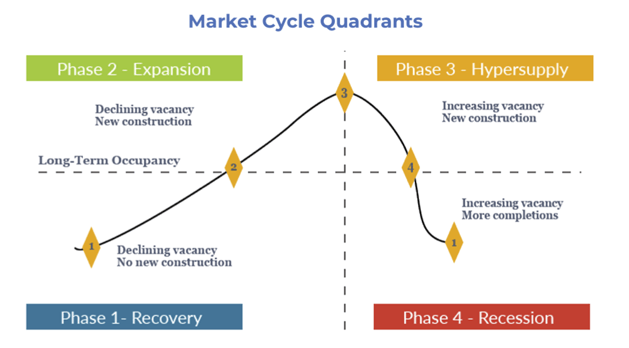

Cycles can influence transaction activity, property values, occupancy, and rents and are dependent on location, property type, and quality. As illustrated here by the work of Glenn Mueller, Ph.D. at the University of Denver, Daniel College of Business1, each phase of the market cycle has unique characteristics that influence the performance of real estate. It’s important to know that not all property types experience the cycle at the same time or in the same way.

Mueller: Real Estate Finance 1996

Mueller: Real Estate Finance 1996

And while today, we believe it is reasonable to assume most sectors are either in the Hypersupply or Recession phases, some property types are less sensitive to the cycle’s influences and can be supported by demand drivers that enable a smoother transition from one phase to another.

Life-Event-Driven Property Types

Life-event-driven sectors often exhibit resiliency and continue to perform well even when other properties may not. Some of these include lesser-known commercial real estate sectors like:

- Student Housing

- Self-Storage

- Healthcare

- Manufactured Housing Communities (MHC)

- Senior Living

At first glance, you may recognize these property types as those that have intersected with your life at one time or another. This is why they are considered life-event-driven asset classes. Most of us will encounter one or more of these at one time or another in our lives, highlighting why there is typically a strong demand for these property types.

Consider the current strength and dynamics of just a few:

Student Housing

According to recent industry research reports:

- The Fall 2024 pre-lease season shows that a record number of students are rapidly leasing beds. As of November 2023, 28.8% of beds at the core 175 universities tracked by RealPage Market Analytics had been claimed for the Fall 2024 academic year.2

- Preleasing for the 2024-2025 school year started off extremely strong, reaching 25.2% for the Yardi 200 by October 2023, well ahead of last year’s record-setting pace of 10.4% preleased in October 2022.3 The Yardi 200 includes the top 200 investment grade universities across all major collegiate conferences.

- In October 2023, the average asking rent per bed was $854 among the Yardi 200 for the 2024- 2025 school year, slightly higher than where it ended the 2023 preleasing season in September 2023 and 6.6% higher than October 2022. Some of the schools with the fastest preleasing are already seeing rents up 15-25% year-over-year.3

- Fall 2023 enrollment numbers for the Yardi 200 schools indicate a rebound in enrollment growth from the prior year, which is likely benefiting the student housing market.3

Self-Storage

According to industry-stalwart Storage Cafe4:

- Self-storage grew to more than 1.8 billion square feet of space in 2024. Over the last 5 years, 268.2 million square feet of storage space has been built.

- In 2024, roughly 54.4 million sq. ft. of new self-storage space is planned to be completed across the U.S. That represents a 3.4% increase compared to 2023 deliveries.

- As of February 2024, a fifth of Americans (18%) use self-storage, with a further 14% intending to rent some in the future.

Outpatient Healthcare

According to data research specialist, ResourceMed:5

Post-pandemic, outpatient physician-office employment is growing faster than underlying supply of space. As of Q3 2023, physician office employment grew 3.3% annually while the outpatient or MOB inventory grew by just 1%. Interestingly, during this period we have seen occupancy rates for the outpatient sector growing consistently as absorption of space has been outpacing completions.

Meeting Consumer Needs Throughout Life

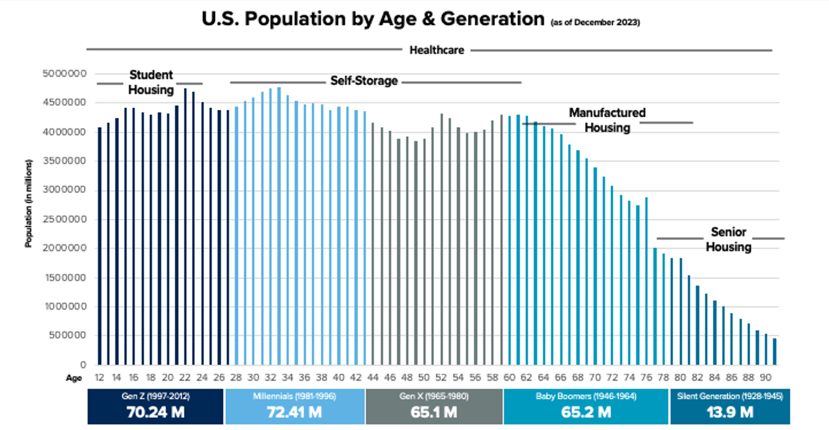

This chart may help illustrate how life-event-driven assets are often needed throughout consumers’ lives and shows how the demand for certain real estate sectors is positioned to continue for decades to come thanks to the growth and aging of different generations.

Source: U.S. Census Bureau

Source: U.S. Census Bureau

A Case Study: Off to College

Perhaps the best way to show how life-event-driven properties can readily touch several needs in our lives is to provide a sample case study:

Robert and Sue Farrington have been married for forty years, have three daughters (two now in college; one a senior in high school) and have lived in the same home in Milwaukee, Wisconsin since the very beginning. Robert is a patent attorney who remains as active today as when he started, and Sue works part-time at a pediatrician's office.

With their two oldest daughters, Nora and Grace, now in college, and Sara soon-to-be, the Farringtons find themselves in full “spend mode” covering expenses for tuition, room and board, and activities. They knew the cost would be high, just not quite this high!

Nora and Grace live in off-campus student housing while attending the University of Wisconsin-Madison. They currently share an apartment but have decided to split up next year and live with friends. The sisters were able to sign, with their parents as co-signers, a 12-month lease which is the typical term for off-campus housing. The assurance of consistent annual income, despite a few months of summer vacancy, is an attractive advantage for student housing investors.

Nora and Grace’s furniture will need to be moved once the spring term ends, so the Farringtons will rent a self-storage unit in Madison for the summer months.

Meanwhile, back home, Sara, who is an elite soccer player with pending offers at several Division One schools, just tore her ACL which will require surgery and several months of physical therapy. And while the unfortunate event wasn’t an expected expense for the Farringtons, fortunately, all of Sara’s medical treatment will be accommodated at a renowned orthopedic outpatient surgery clinic near their home.

These are the types of stories and scenarios that resonate with investors, so we encourage you to share your own experiences the next time you're having conversations with your clients about real estate as an alternative asset class.

Some of the risks related to investing in commercial real estate include, but are not limited to: market risks such as local property supply and demand conditions; tenants’ inability to pay rent; tenant turnover; inflation and other increases in operating costs; adverse changes in laws and regulations; relative illiquidity of real estate investments; changing market demographics; acts of God such as earthquakes, floods or other uninsured losses; interest rate fluctuations; and availability of financing.

1https://daniels.du.edu/assets/Cycle-Monitor-23Q2.pdf

2https://www.realpage.com/analytics/november-2023-student-housing-update/

4https://www.storagecafe.com/self-storage-industry-statistics/

5https://revistamed.com/demand-for-outpatient-space-growing-faster-than-supply/