Demand for commercial real estate (CRE) generally reacts to the ebbs and flows of the broader economic market.

The economic cycle, often called the business cycle, is the fluctuation of the economy between periods of growth and recession. Standard phases of the economic cycle are early-cycle (expansion), mid-cycle (peak), late-cycle (contraction) and recession (trough). On average, economic cycles last between five and seven years.1

Factors in determining where the economy is relative to the cycle include:

- Gross domestic product (GDP) movements

- Interest rate fluctuations

- Employment rate trends

- Consumer spending changes

CRE Cycle Returns

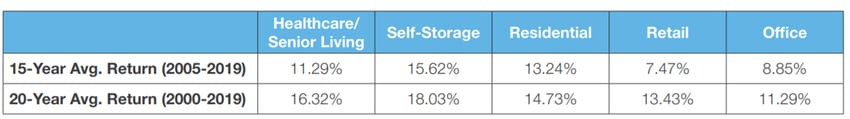

Similar to the broader economic market, commercial real estate is cyclical and is not immune to the ups and downs of the economic cycle. The demand for commercial real estate typically reacts to the various conditions presented by the economic cycle, thus affecting returns whether positive or negative. It’s important to keep in mind that not all CRE assets are created equal. Healthcare, including senior living, self-storage and residential/multifamily have historically demonstrated stronger fundamentals throughout multiple economic cycles as compared to other core real estate sectors. Keep in mind that each individual asset offers its own set of strengths and weaknesses, including property type, market, geographic location, and tenants.

Sector-By-Sector Returns

While past performance is not a guarantee of future results and circumstances surrounding each economic cycle are unique, healthcare/senior living, self-storage and residential/multifamily have generated the most attractive returns over 15 and 20 years while experiencing a range of ups and downs in economic cycles. It’s important to keep in mind the data represented in the following table is based on full-year returns and does not reflect current returns that may be affected by the COVID-19 pandemic. The length and ultimate magnitude of COVID-19’s effects are unfortunately uncertain and multiple aspects of the economy, including commercial real estate sectors, are expected to be negatively affected by the pandemic. Source: NAREIT Annual Index Values & Returns, available at https://www.reit.com/data-research/reit-indexes/annual-index-values-returns.

Source: NAREIT Annual Index Values & Returns, available at https://www.reit.com/data-research/reit-indexes/annual-index-values-returns.

Healthcare/Senior Living

The healthcare/senior living sector’s strong historical performance is driven by the demand for delivering healthcare outside the traditional hospital setting and an aging U.S. population. As the population of Americans 65 years and older continues to grow year-over-year, the need for senior care facilities, such as independent and assisted living communities, is expected to increase. According to Marcus and Millichap’s Summer 2020 Senior Housing Special Report:

- By 2028, 20.1% of the total U.S. population will be 65 years and older

- Average annual rent for assisted living communities is nearly $5,000/month

- Occupancy rates for independent living communities was 89.7% in Q1 2020

Self-Storage

Demand for self-storage is driven by life events including marriage, divorce, birth, death, relocation, and the need for extra space, all of which occur regardless of the economic environment. Most self-storage properties offer month-to-month leasing opportunities, onsite security, and 24-hour access. Generally, self-storage tends to experience minimal impact from economic upturns and downturns. According to SpareFoot Storage Beat3:

- 9.4% of renter households use self-storage units

- There is 1.7 billion square feet of rentable self-storage space in the U.S.

- $39 billion annual industry revenue

Residential/Multifamily

Residential is often categorized as a “traditional” real estate asset class. People will always need a place to live. In fact, the demand for residential real estate continues to grow as people are looking for affordable housing options such as renting versus owning a home. Data shows:

-

An estimated 33% of U.S. households rent4

-

National rents average $1,460/month5

-

Vacancy rate average of 5.7% in Q2 20206

Historical data and emerging trends demonstrate the strong fundamentals of these specific commercial real estate sectors among the broader range of CRE strategies, although there can be no guarantee of sector outcomes during the various economic market cycles. The healthcare, self-storage and residential/multifamily commercial real estate sectors are sectors that have the potential to efficiently navigate the overall economic cycle.

*It’s important to keep in mind the data represented above may be affected by the current COVID-19 pandemic.

Sources:

1 Investopedia. Economic Cycle. May 2020

2 Marcus & Millichap. Beyond The Global Health Crisis. Special Report. Senior Housing. Summer 2020

3 SpareFoot Storage Beat. Self-storage sector snapshot. March 2020

4 US Census Bureau. Quarterly Residential Vacancies and Homeownership, Q1 2020. April 2020

5 Yardi Matrix. Multifamily National Report. July 2020

6 U.S. Census Bureau. Quarterly Residential Vacancies and Homeownership, Q2 2020. July 2020

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forward-looking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Investments in real estate assets are subject to varying degrees of risk and are relatively illiquid. Several factors may adversely affect the financial condition, operating results and value of real estate assets. These factors include, but are not limited to:

-

changes in national, regional and local economic conditions, such as inflation and interest rate fluctuations;

-

local property supply and demand conditions;

-

ability to collect rent from tenants;

-

vacancies or ability to lease on favorable terms;

-

increases in operating costs, including insurance premiums, utilities and real estate taxes;

-

federal, state or local laws and regulations;

-

changing market demographics;

-

changes in availability and costs of financing;

-

acts of nature, such as hurricanes, earthquakes, tornadoes or floods;

-

economic risks associated with a fluctuating U.S. and world economy, including those resulting from the novel coronavirus and resulting pandemic.