Following a disappointing year for stocks and bonds in 2022 and an uneven recovery throughout 2023, many financial professionals are searching for better ways to diversify their asset allocations. Fortunately, there are several alternative investment strategies financial professionals are turning to in order to balance a traditional stock and bond portfolio.

Against this backdrop, commercial real estate continues to draw increasing attention among financial professionals as a non-correlated asset that may help reduce portfolio volatility and potentially provide an alternative source of income.1 However, the commercial real estate market is vast, and identifying the appropriate investment structures and asset types is challenging.

This blog provides insight into a few commercial property types that appear well-positioned for continued growth in the years ahead and that we believe should warrant consideration as a real estate allocation.

Complimenting the Core Four

Most financial professionals are familiar with what is commonly referred to as the core four commercial property types - office, retail, multifamily, and industrial. These asset classes have long been recognized as the large anchors that constitute the commercial property market and that, over time, have tended to weather changing market cycles.

Yet the COVID-19 pandemic created a tremendous disruption among certain commercial properties like office and retail, making it much more difficult for financial professionals to project the future performance of these strategies. Subsequently, other property sectors have moved to the forefront as demographic and demand drivers change, and a few could be effective compliments for a balanced portfolio.

Self-Storage

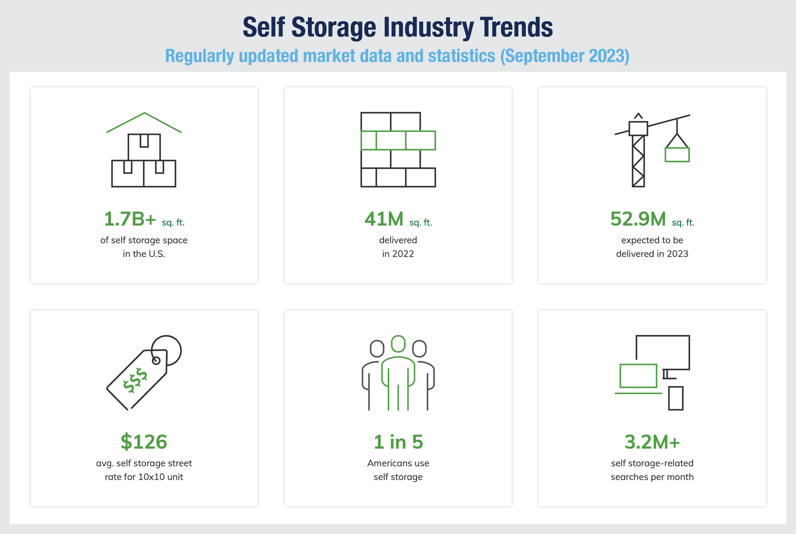

To get a sense of the size of the self-storage market, a visual snapshot may be the best approach.

Source: storagecafe.com2

The U.S. self-storage market has been one of the top-performing commercial real estate sectors for the last few years, fueled by many of the consumer behavioral changes induced by the pandemic. Yet the sector appears to be on solid ground going forward. As noted recently by CBRE Investment Management:

“Operating fundamentals have been at, or near, all-time highs the last three years. Occupancy levels are in the 94%-96% range, giving landlords pricing power and driving robust revenue growth nationwide. Average rents have risen by an average of 5.8% over the past five years, spiking 17.4% in 2021, according to Yardi Matrix reporting of self-storage REITs. Consequently, the sector has proven to be a strong inflation hedge, with annual rent growth largely outpacing CPI over the past five years.” 3

Source: CBRE, May 2023

With many companies adapting to a hybrid workplace culture, the demand for self-storage continues as many Americans are changing living situations.

And we believe that demographic trends such as relocation and the aging of the millennial generation also continue to be strong drivers of self-storage.

In fact, the self-storage sector is recognized as a unique asset class that takes advantage of omnipresent life events known as the “Four D’s.”

-

Death

-

Divorce

-

Downsizing

-

Dislocation

Healthcare

The healthcare sector, which consists of properties such as medical office buildings, senior living facilities, hospitals, etc., is growing despite economic headwinds. The aging U.S. population is increasing the need for medical services and senior housing facilities. The United States Census Bureau has reported that by the end of 2023, those aged 75+ will increase to 24.4 million, and Americans 85 years or older will hit 6.9 million.4

By 2030, all baby boomers will be older than age 65 – meaning that one in five Americans will be of retirement age. By 2060, that number will increase to nearly one in four Americans who will be 65 years old or older.5

Significant Subsectors

Medical Office Buildings

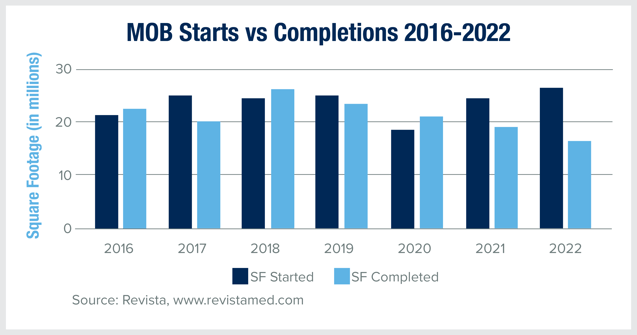

The trend toward outpatient care was accelerated by the COVID-19 pandemic and highlighted the importance of well-equipped and well-located healthcare facilities. We believe that the growth of medical office buildings (MOBs) reflects the healthcare industry’s need to offer more local services instead of relying on one large hospital or health system alone.

Outpatient care helps reduce the strain on hospitals, allowing them to focus on treating patients who do not require hospitalization but must have a medical procedure. These consumer advantages have driven continued growth in the MOB market, as you can see here.

Senior Housing

The senior housing subsector has its own set of demand drivers that we believe will likely fuel growth for many years. Demand for senior housing facilities is expected to increase significantly in the coming years due to the long-term tailwinds from the aging baby boomer generation. Increasing occupancy rates and other factors tell the story.

Increasing Occupancy Rates6

The senior housing occupancy rate rose to 83.7 percent in the second quarter of 2023, according to a report from the National Investment Center for Seniors Housing & Care. That increase marked a 0.6 percentage point gain from the first quarter of 2023.

Annual Rental Rate Growth7

Data from the recently released second quarter 2023 NIC MAP Vision Seniors Housing Actual Rates Report revealed that year-over-year asking rate growth for the independent living segment was the strongest, at 9.8%, compared with assisted living and memory care. Independent living in-place rates also were up by 9.4% from 2022, and move-in rates were up by 8%.

Benefitting from Robust Migration8

Almost half (45%) of all senior housing construction is taking place in the Southeast, Mid-Atlantic and Southwest areas of the country.

Student Housing

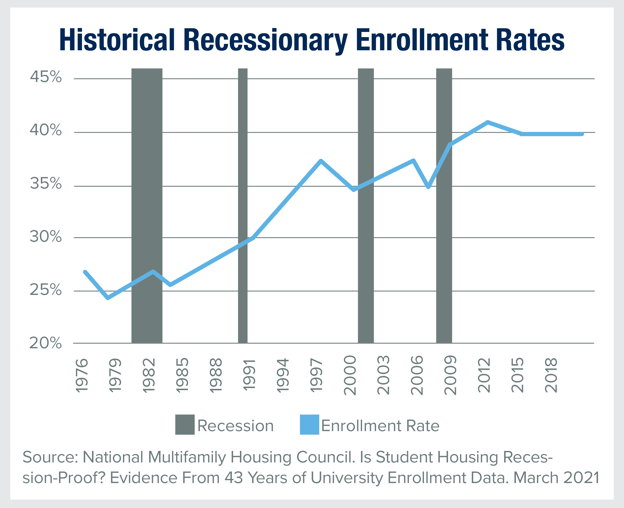

We believe that student housing remains a recession-resilient commercial real estate sector amid economic uncertainty and global instability.

Enrollment Remains Strong

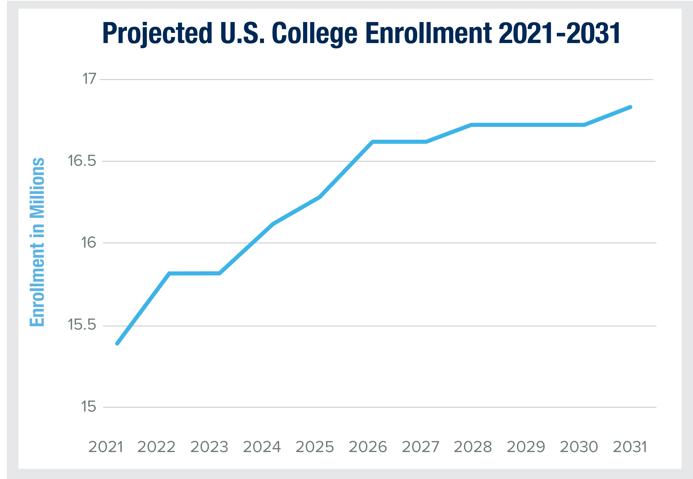

Although U.S. colleges and universities are experiencing a short-lived decline in enrollment rates, according to the National Center for Education Statistics (NCES), the number of high school graduates realizing the importance of a college degree and its impact on future career opportunities and potential wealth is increasing. Projected numbers for total enrollment in postsecondary institutions are expected to remain relatively steady and consistent from 2021 to 2031.9

Historical Recessionary Enrollment Rates

According to research by NMHC, historical college enrollment rates are generally not impacted by economic recessions. In fact, college enrollments continued to increase steadily from 1976 to 2018 amid four different recessions.

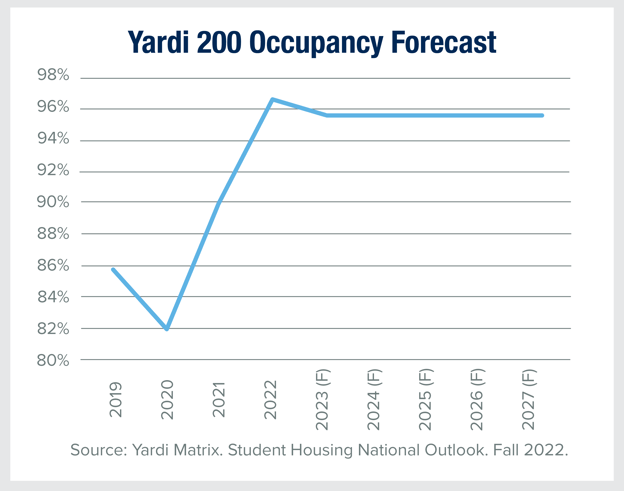

Stable Occupancy Expected at Many Schools

As reported in the Yardi Matrix National Student Housing Report, Q3, 2023:

“Fall 2023 leasing activity hadn’t lost any steam through the second quarter. As of June, 86.6% of beds at Yardi 200 universities were preleased, a slight increase from last year but a 5.2% jump from May. Preleasing levels approaching 90% with a couple months before students start arriving on campus signifies a very impressive leasing season.” 10

Commercial real estate strategies come in many forms, from relatively conservative income-oriented solutions to more aggressive opportunistic approaches. Understanding that each sector performs differently throughout market cycles helps in selecting a long-term strategy that may be well-positioned amid all market cycles.

Sources:

1 All Eyes on Alts. Investment News. February 2023.

2 Self Storage Industry Trends. Storage Cafe.

3 The Resiliency of Self Storage and Return to New Normal. CBRE Investment Management. May 2023.

4 2023-2028 Seniors Growth and Demand Report. Integra Realty Resources. March 2023

5 The Graying of America: More Older Adults Than Kids by 2035. United States Census Bureau. March 2018

6 NIC Report: Senior Housing Occupancy Up 8 Straight Quarters. Multi Housing News. July 2023

7 Senior living asking rates hit near-record highs in the second quarter. Mcknight's Senior Living. September 12, 2023

8 Experts optimistic that senior housing is rebounding: report. McNights Senior Living. March 6, 2023

9 Undergraduate Enrollment. Accessed November 2023. National Center for Education Statistics

10 National Student Housing Report. Yardi Matrix. Q3, 2023. The student housing data set includes over 2,000 universities and colleges nationwide, including the top 200 investment grade universities across all major collegiate conferences. Known as the “Yardi 200,” it includes all Power 5 conferences as well as Carnegie R1 and R2 universities.

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forward-looking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Some of the risks related to investing in commercial real estate include, but are not limited to: market risks such as local property supply and demand conditions; tenants’ inability to pay rent; tenant turnover; inflation and other increases in operating costs; adverse changes in laws and regulations; relative illiquidity of real estate investments; changing market demographics; acts of God such as earthquakes, floods or other uninsured losses; interest rate fluctuations; and availability of financing.