|

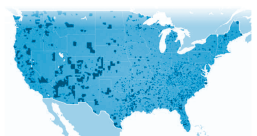

Since the creation of the Qualified Opportunity Zone (QOZ) program in 2017 as part the Tax Cuts and Jobs Acts, with a focus on low-income communities and census tracts across the country, these investments have raised approximately $75 billion1. Opportunity zones provide an incentive to allocate funds to help spur economic development and job creation in exchange for a temporary tax deferral and potential tax elimination. An investment in a QOZ property before the December 31, 2021 deadline may qualify for a 10 percent step-up in basis, a readjustment of the asset to current fair market value, thus reducing capital gains tax due on the original gain. Approximately 8,700 Identified Opportunity Zones Nationwide2

How Does Investing in a QOZ Work?The tax benefits of investing in QOZs may be enticing for those with capital gains, however, it is important to know that realized gains must be invested into QOZ property within 180 days from the date of the sale or exchange of the appreciated asset. Investments will not be taxed on the sale of the assets until 2026 and may qualify for a 10 percent step-up in basis on the original gain if the investment occurred on or before December 31, 2021, thus decreasing the overall tax payment. After a full 10-year hold, the investment may qualify for full capital gains tax elimination. |

What to Expect for QOZs in the Coming Months?3

With the current economic conditions, coupled with the 2020 presidential election results, the uncertainties surrounding commercial real estate are likely to continue. Investments into QOZs would generally expect to deliver new job creation, affordable housing options and an array of ventures in both rural and urban areas. According to the U.S. Census data and analysis, the average opportunity zone has a median household income of $33,345, a poverty rate of 31.75 percent, and an unemployment rate of 13.41 percent. A total of 31.3 million people across the United States live in areas that have been designated as opportunity zones, which include a racially diverse population.

Illustration of a QOZ Investment

The example on the following page illustrates an investment realizing capital gains from an asset sale and what tax implications it may assume when making a QOZ investment. In this example, the amount of capital gains realized is $1 million and assumes an annualized 8 percent return on the investment. The noticeable difference on the taxes paid on a QOZ investment as compared to other investments is the amount of taxes paid over the term of the new investment and the timing of the tax payments due. When investing in a QOZ property prior to December 31, 2021, the capital gains tax is deferred and paid in 2026 and also receives a 10 percent step-up in basis, thus lowering the taxable amount.

Explanation of Calculations Used in the QOZ Investment Illustration

How is capital gains tax calculated for the QOZ investment in year 2026?

- Due to the 10% basis step-up on the capital gains realized of $1M, the taxable amount is lowered to $900,000

($1M x 0.90 = $900,000). - The tax is calculated by taking 26% of the $900,000 capital gains ($900,000 x 26% = $234,000).

What happens after the 10-year hold period on the new QOZ investment?

- The QOZ investment benefits from complete tax elimination.

Illustration of QOZ InvestmentCapital Gain from Sale of Asset: $1,000,000 Long-Term Capital Gains Rate (Federal & State): 26% Annualized Return: 8%* *NCREIF Index representing direct real estate returns. |

The return assumption for direct real estate is represented by the National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index (NPI), an index of quarterly returns reported by institutional investors on investment grade commercial properties owned by those investors. The NPI is used as an industry benchmark to compare an investor’s own returns against the industry average. While not a measure of QOZ performance, the NPI is an appropriate and accepted index for the purpose of evaluating real estate growth rates. The NPI does not reflect management fees and other investment-entity fees and expenses, which lower returns. Indices are not available for direct investment. Index performance may differ significantly from a QOZ. Additionally, a QOZ has fees and expenses not found in an index. Past performance does not guarantee future returns. |

| 2021 | ||||||||||

|

||||||||||

| 2026 | ||||||||||

|

||||||||||

|

Sources:

1https://news.bloombergtax.com/daily-tax-report-state/three-years-of-opportunity-zones-and-outlook-for-2021

2Fund for Our Economic Future’s analysis of Qualified Opportunity Zone tracts, as designated by the U.S. CDFI Fund.

3The Motley Fool. Opportunity Zones Could Stand Up and Stand Out in 2021. December 4, 2020.

4https://missioninvestors.org/resources/opportunity-zones-how-communities-were-selected-participation#:~:text=A%20total%20of%2031.3%20million,Zones%20contain%20 Native%20American%20lands.

Disclosure

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forward-looking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Risk Factors to Consider

An investment in real estate involves significant risk and is suitable only for investors who have adequate financial means, desire a relatively long-term investment and who will not need immediate liquidity for their investment and can afford to lose their entire investment.

Investments in real estate are subject to varying degrees of risk, including, among other things, local conditions such as an oversupply of space or reduced demand for properties, an inability to collect rent, vacancies, inflation and other increases in operating costs, adverse changes in laws and regulations applicable to owners of real estate and changing market demographics.

QOZ Risk Factors to Consider

There are substantial risks associated with the U.S. federal income tax aspects of a purchasing interests in a qualified opportunity fund. The following risk factors summarize some of the tax risks to an investor. All prospective investors are strongly encouraged to consult with and rely on their own tax advisors. The tax discussion here is not intended, and should not be construed, as tax advice to any potential investor.

- There is a lack of precedent and limited guidance related to qualified opportunity funds.

- A program intended to qualify as a qualified opportunity fund may not constitute a qualified opportunity fund for a variety of reasons, including a failure to substantially improve the property within the first 30 months of its operation. If a fund does not qualify as a qualified opportunity fund, then no deferral or elimination of taxable gain will be available to the its members.

- An investor must acquire his or her interest in a qualified opportunity fund on or before December 31, 2019 in order to receive a step-up in basis equal to 15% of the gain deferred by reason of the investment in the fund.

- Investors who hold interests in a qualified opportunity fund through December 31, 2026,

and who have deferred gain through that time by acquiring such interests, will automatically recognize some or all of the federal income tax gain that they deferred on December 31, 2026. - The state, local and other tax implications of a qualified opportunity zone investment are unclear.